I hope this message finds you well! Given the current dynamics in the housing market, I wanted to share some important insights that reflect both the challenges and the potential future trends in U.S. home sales.

Table of Contents

Historical Context and Current Challenges

The U.S. existing home sales market is currently experiencing a significant downturn, with sales figures reminiscent of the late 1970s (not to be confused with home prices, we’re talking about the amount of homes selling within a given period). To put it in perspective:

April 1978 saw 4.09 million U.S. existing home sales.

April 2024 recorded 4.14 million, despite the substantial growth in the U.S. population from 223 million in 1978 to 341 million in 2024.

This stark contrast highlights a major issue: housing affordability has deteriorated significantly, causing both buyers and sellers to hesitate.

Many homeowners are choosing to hold onto their low-interest mortgages rather than upgrade or downsize at current higher rates, contributing to a stagnation in the market. This contributes to fewer homes for sale (inventory), which creates less competition for sellers, and fewer options for buyers. This is why home prices have continued to increase overall, even with fewer home sales.

Home Sales Forecast

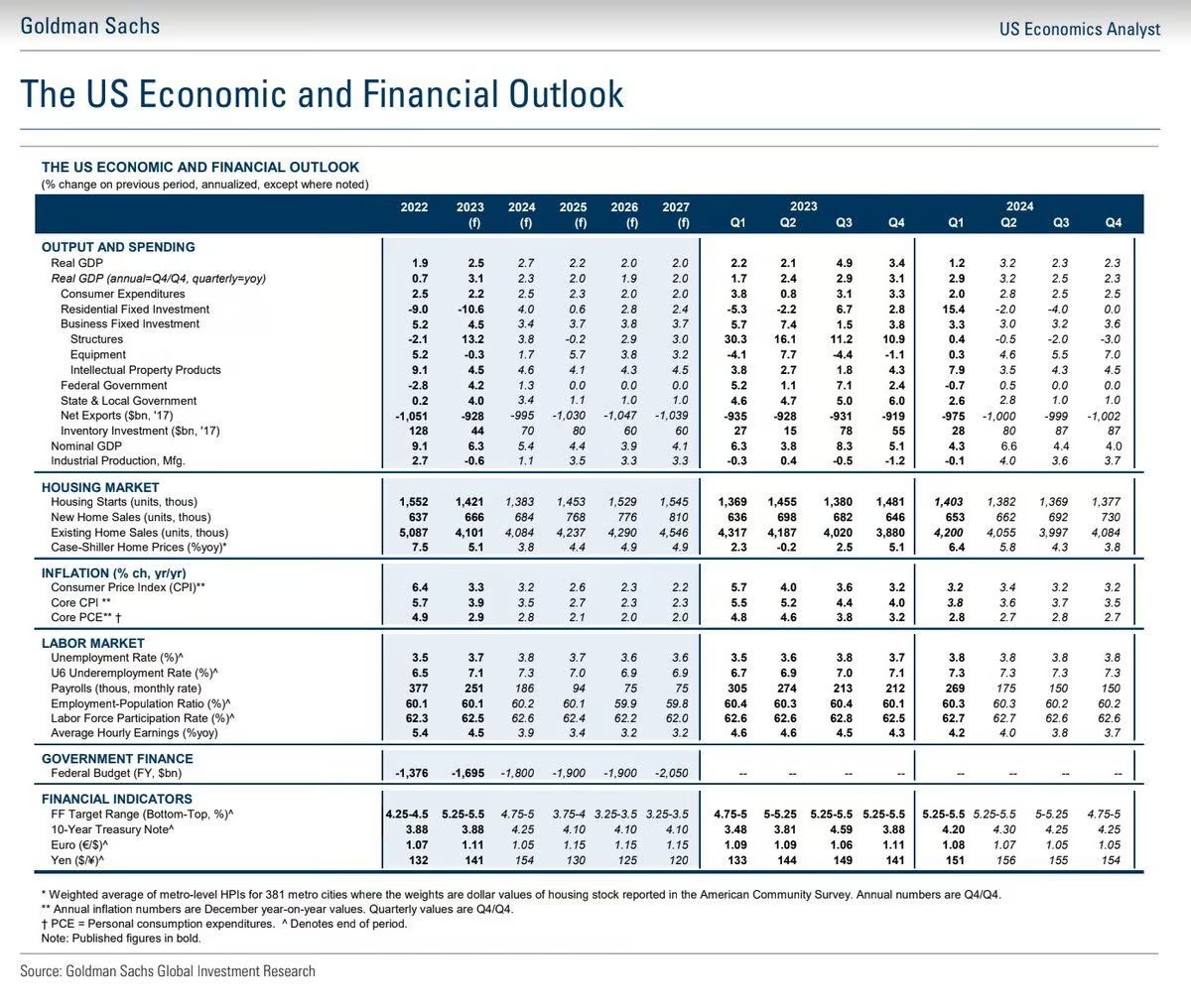

According to a recent forecast by Goldman Sachs, the path to recovery for existing home sales appears slow. They predict a gradual increase from 4.1 million sales in 2024 to 4.5 million by 2027. This is notably lower than the highs seen during the Pandemic Housing Boom of 2021 and even the pre-pandemic “normal” of 5.3 million sales in 2019.

Regional Differences

While some areas, particularly in the Mountain West and parts of Texas, have seen pricing corrections, tight inventory in the Northeast and Midwest has continued to drive price increases. This regional disparity underscores the uneven impact of the current home sales downturn.

Comparing New vs. Existing Home Sales

The new home sales market has fared somewhat better, thanks to the flexibility of homebuilders who aren’t affected by the “lock-in effect” and have more leeway to adjust pricing and terms to meet market demands. Unlike many sellers in the existing homes market, builders have been more proactive with strategies such as price cuts or mortgage rate buy-downs to encourage sales.

Mortgage Rate Predictions and Home Price Forecast

Goldman Sachs projects that the average 30-year fixed mortgage rate will decrease to 6.5% by the end of 2024 and further to 6.3% by the end of 2025. They also forecast a rise in U.S. home prices by 3.8% in 2024 and 4.4% in 2025, suggesting a potential easing of the current affordability crisis as rates decline. Bellow is a detailed chart showing Goldman Sachs US Economic and Financial Outlook for the next 3 years.

Looking Ahead

While the immediate outlook suggests a challenging environment for home buyers, the anticipated adjustments in mortgage rates and continuing efforts by builders to address affordability may provide some relief.

P.S. While there are challenges in this market, homes continue to sell every single day. If you’re considering buying or selling in this market or just want to discuss how these trends might impact your real estate strategy, please reach out.

Looking forward to our conversation.

Here to serve,