Hi {{first name|there}},

I'm excited to share some compelling insights about homeownership and its impact on personal wealth. The decision to buy or rent a home is significant, and understanding the long-term financial implications is crucial.

Table of Contents

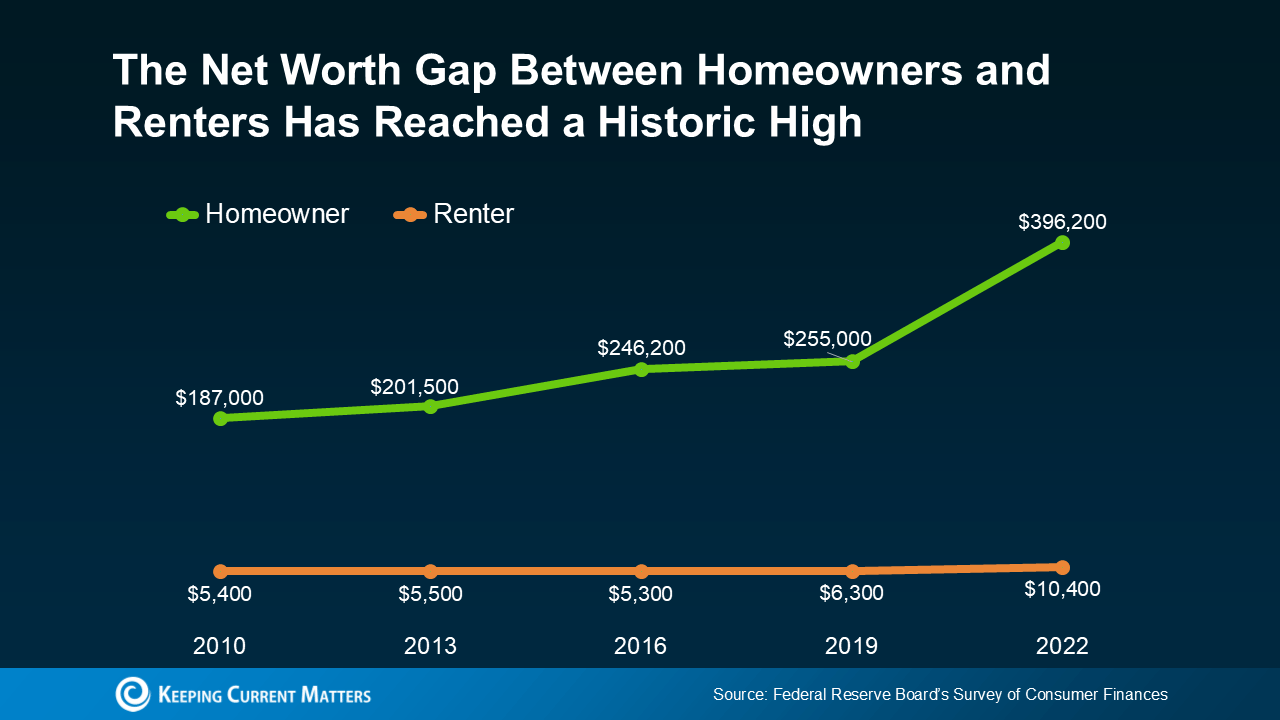

The Net Worth Gap: Owners vs. Renters

There is a striking difference in net worth between homeowners and renters. This gap underscores the potential financial benefits of homeownership:

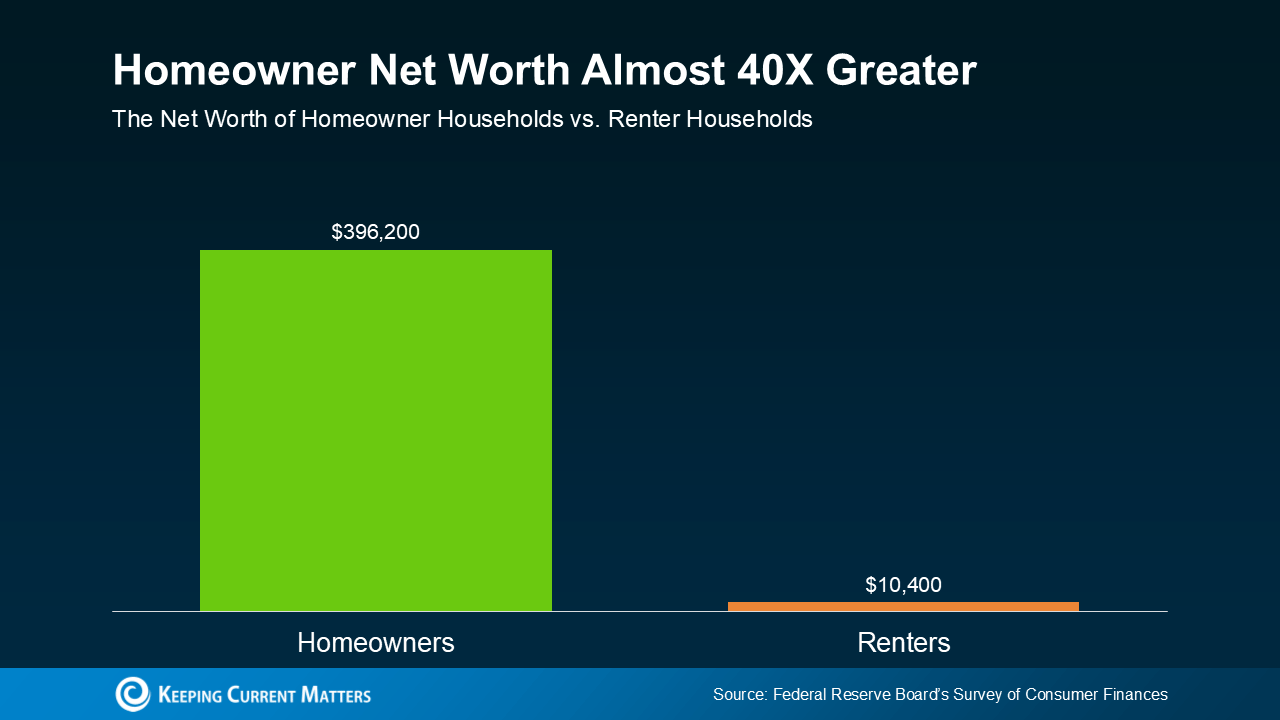

Homeowners have a median net worth of $396,200

Renters have a median net worth of $10,400

This substantial difference - nearly 40 times greater for homeowners - highlights how property ownership can be a powerful tool for building wealth over time.

Why the Gap Exists

Several factors contribute to this significant disparity:

Appreciation: As property values appreciate, homeowners build equity - a key component of net worth. Real estate allows you to get outsized returns from relatively small investments.

As an example, if you were to invest $25,000 into the stock market, your average return over the past several decades would have been around 10%, amounting to a total of $2,500 increased value within that first year. Or… you could use that same $25,000 as a 5% down payment on a $500,000 home. If home values increased just 3% over that year, your home would be worth $515,000 by the end of that first year, a total of $15,000 of increased value. In other words, you would have seen a 60% return on your $25,000 down payment. This is just an example, but shows how when starting your wealth building journey, real estate can offer huge returns through a relatively small investment due to a banks willingness to finance your home.

Forced Savings: Monthly mortgage payments act as a form of forced savings, gradually increasing the owner's equity by lowering their debt.

Tax Benefits: Homeowners often enjoy income tax deductions related to mortgage interest and property taxes.

Stability: Owning a home can provide financial stability and protection against rising rental costs.

Inflation Resistant: Hard assets like real estate act as a protection against inflation. Especially in an inflationary environment like we’ve seen over the past several years.

What This Means for You

If you're considering buying a home, this information underscores the long-term financial benefits. While renting offers flexibility, homeownership presents an opportunity to build substantial wealth over time.

Every financial decision should align with your personal goals and circumstances, and I'm here to help you find the best solution for your unique situation.

Whether you're a first-time buyer, looking to upgrade, or simply curious about the market, don't hesitate to reach out. Let's discuss how homeownership could fit into your financial future.

Here to serve,

| |||||||||||||||

🎁 PS…We’re giving away some gift cards! 🎁

This month officially marks 1 year since starting this newsletter. To celebrate, we’re rebranding this blog to “Confessions of a Utah REALTOR®” and giving away a $100 Amazon gift card to one lucky winner, plus a $300 vivint reward* to each person who refers 5 people to this newsletter. The $100 Amazon gift card winner will be selected at random before Christmas. The rules to enter the giveaway are as follows:

Recommend this newsletter to at least one other person by sharing your unique referral link. For each person that signs up, you earn one entry. The more people you refer, the greater chance you have of winning! Fake/spam referrals will not be counted.

If you’re reading this online and want to enter the giveaway, subscribe now, and you’ll get a referral link sent to your email.

*Only new vivint customers will be eligible for the $300 vivint reward.